Smooth Payroll Services for Your Business Requirements-- Contact CFO Account & Services for Payroll Services

Smooth Payroll Services for Your Business Requirements-- Contact CFO Account & Services for Payroll Services

Blog Article

Browsing Compliance Challenges: Just How Professional Payroll Solutions Ensure Legal Accuracy

In the world of company procedures, ensuring compliance with legal needs is critical, particularly when it comes to payroll management. Expert payroll solutions have emerged as an essential resource for companies looking for to browse this elaborate landscape.

Relevance of Compliance in Payroll

Ensuring conformity with guidelines and legislations regulating payroll is extremely important for organizations to maintain legal integrity and economic security. Pay-roll compliance encompasses sticking to government, state, and neighborhood guidelines concerning employee settlement, taxes, advantages, and coverage requirements.

Effective conformity in payroll entails numerous facets, consisting of proper category of staff members, precise calculation of salaries and overtime, prompt settlement of tax obligations, and careful record-keeping. In addition, compliance encompasses ensuring that all employee deductions, such as for medical care or retired life plans, are refined correctly. Failure to meet these conformity criteria can lead to legal disagreements, audits, and economic obligations that can substantially impact a firm's lower line.

Furthermore, conformity in payroll not just reduces lawful threats yet likewise promotes a favorable job setting by instilling count on and openness among staff members. It shows a commitment to ethical company methods and employee well-being, eventually contributing to business success and sustainability.

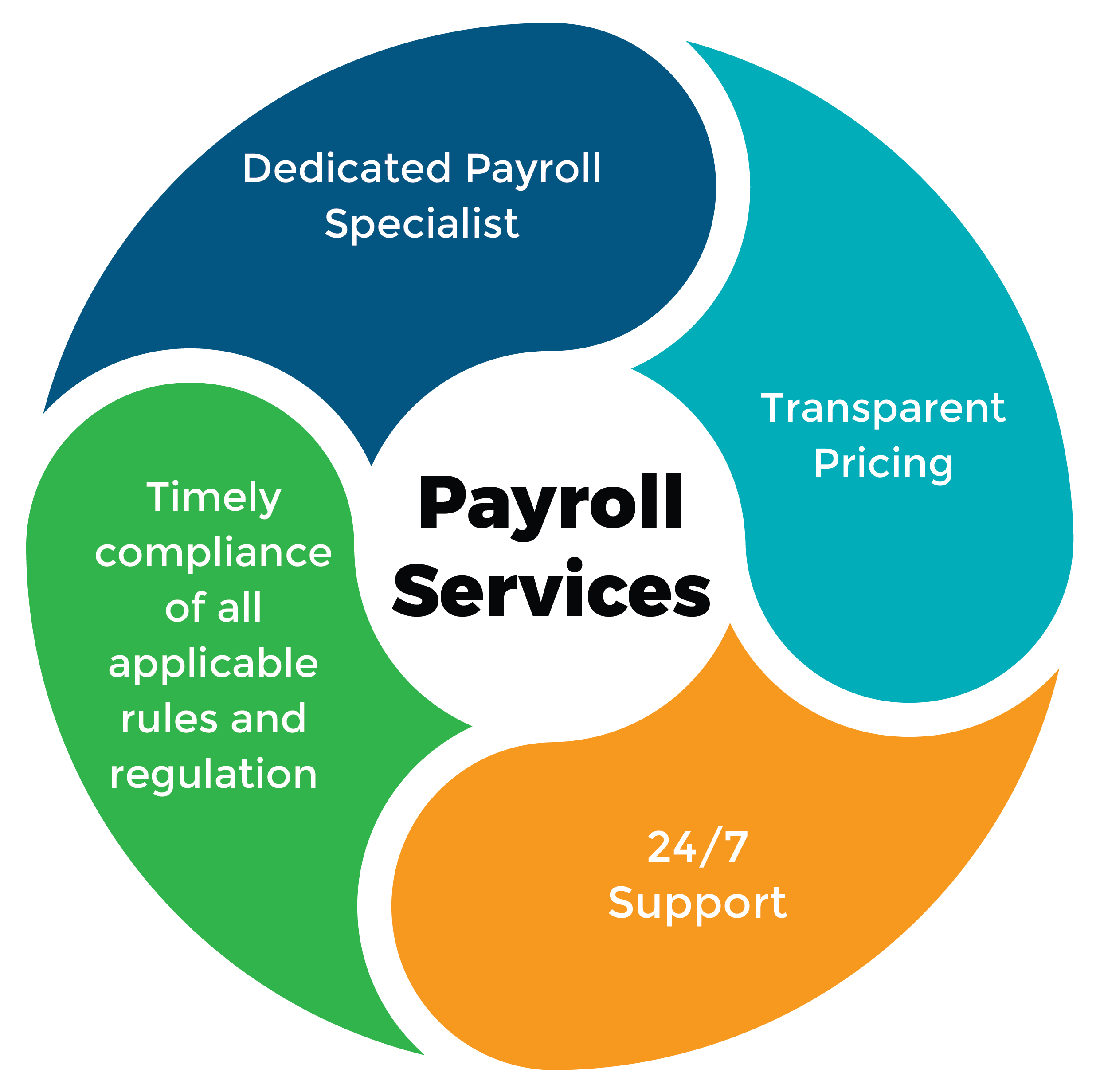

Benefits of Professional Pay-roll Services

Preserving precise compliance requirements in pay-roll procedures requires a critical factor to consider of leveraging professional payroll services to improve performance and accuracy in handling economic responsibilities. Expert payroll services use a myriad of advantages to companies, ranging from little business to huge corporations. To start with, these services provide expertise in navigating intricate payroll guidelines and tax laws, making sure that firms remain compliant with ever-changing regulations. By contracting out pay-roll jobs to experts, organizations can concentrate on their core tasks without being burdened by the intricacies of payroll handling.

Secondly, expert payroll solutions simplify management processes, such as calculating reductions, salaries, and tax obligations, consequently saving time and reducing the probability of errors. Contact CFO Account & Services for payroll services. This effectiveness not only enhances employee complete satisfaction by making certain timely and accurate settlements yet likewise adds to general operational efficiency

Moreover, utilizing specialist payroll services can cause cost financial savings in the future. By avoiding expensive conformity mistakes and charges, organizations can mitigate financial dangers and enhance their source allotment. In addition, contracting out pay-roll functions can minimize the demand for in-house payroll personnel and connected expenditures, making it an affordable solution for numerous companies. Inevitably, the advantages of professional payroll services extend past legal conformity, encompassing operational performance, precision, and economic cost savings.

Duty of Technology in Ensuring Accuracy

Modern technology serves as a keystone in ensuring precision and performance in payroll processes. By leveraging technology, specialist payroll solutions can enhance information entry, computations, and coverage, decreasing errors that might result from hand-operated treatment.

Furthermore, innovation enables real-time information synchronization across various systems, making sure that pay-roll details is current and consistent throughout an organization. This synchronization lowers inconsistencies and reduces the risk of non-compliance with lawful demands. Furthermore, innovation helps with protected data storage and access controls, protecting sensitive payroll information from unapproved accessibility or tampering.

Fundamentally, innovation acts as a driver for precision in pay-roll operations by providing tools for exact calculations, streamlined procedures, and durable data protection measures. Embracing technical improvements within pay-roll solutions is critical for keeping conformity and decreasing mistakes in a significantly complicated regulative landscape.

Compliance Risks for Organizations

In the realm of service operations, browsing conformity risks poses a substantial difficulty for organizations of all sizes. Services encounter a myriad of conformity threats stemming from various sources such as labor legislations, tax obligation regulations, data defense regulations, and industry-specific standards.

Trick compliance risks for services include misclassification of employees, inaccurate payroll handling, non-compliance with overtime regulations, and improper record-keeping - Contact CFO Account & Services for payroll services. In addition, with the boosting intricacy of policies at both the state and government levels, businesses have to stay alert to make sure adherence to all applicable regulations. Specialist payroll services play a crucial role in helping businesses browse these conformity threats by staying updated with laws, implementing durable procedures, and supplying expert support to guarantee lawful accuracy in payroll procedures. By leveraging the knowledge of specialist pay-roll services, companies can properly manage compliance threats and focus on their core operations with confidence.

Exactly How to Pick the Right Company

With the essential demand for companies to promote governing compliance standards, choosing an appropriate pay-roll provider comes to be an important decision-making procedure. When picking the right provider, several key factors ought to be thought about. It is crucial to examine the copyright's experience and expertise in managing payroll services, particularly in markets comparable to your very own. A service provider with a tried and tested record in browsing complex compliance demands can use useful understandings and solutions tailored to your specific needs.

Secondly, consider the technology and software program capabilities of the supplier. A dependable pay-roll solution ought to have learn this here now safe systems in area to safeguard delicate worker information and ensure exact processing. Integration with your existing systems and the capacity to range as your organization expands are likewise critical considerations.

Last but not least, do browse this site not overlook the value of consumer support and responsiveness. A responsive service provider that uses outstanding customer support can help resolve any kind of issues without delay and ensure smooth operations. By thoroughly assessing these factors, services can pick a pay-roll solution company that not only satisfies their conformity requires yet also adds to total performance and productivity.

Final Thought

In verdict, professional payroll solutions play a crucial role in making sure lawful precision and compliance for businesses. By leveraging technology and proficiency, these solutions assist reduce conformity threats and simplify payroll procedures. Choosing the best service provider is important for companies to browse complicated conformity difficulties efficiently. Contact CFO Account & Services for payroll services. Trusting professional pay-roll solutions can inevitably lead to smoother procedures and comfort for businesses striving to meet lawful needs.

Keeping thorough compliance requirements in payroll operations necessitates a calculated factor to consider of leveraging specialist payroll solutions to improve performance and accuracy in managing financial commitments. By outsourcing payroll tasks to professionals, companies can focus on their core tasks without being strained by the details of payroll processing.

Furthermore, outsourcing payroll functions can lower the requirement for internal pay-roll personnel and connected expenses, making it a cost-efficient option for many organizations. Professional payroll services play a vital duty in aiding businesses browse these conformity dangers by remaining updated with regulations, executing durable procedures, and giving experienced assistance to ensure legal accuracy in pay-roll operations.In verdict, professional payroll solutions play an essential role in i was reading this making certain legal precision and compliance for services.

Report this page